how to file taxes if you're a nanny

To claim your babysitting expenses youll need to fill out Schedule C of your tax form and attach it to your Form 1040 for a regular personal income tax return. Solid communication skills are required.

You will also be required to file a tax return if youre a church employee with income of 10828 or more.

. Understand your responsibilities when hiring a nanny housekeepergardener or handyperson. The 8 Best Nanny Payroll Software - April. On the other hand if you dont expect to owe more than 1000 when you file your annual return you arent required to make quarterly tax payments.

If youre filing taxes there are a few key due dates to keep in mind. The taxes withheld from them and your corresponding employer taxes each pay period. The worker may file for unemployment or be injured on the job and youll need to have insurance to cover these situations.

Depending on how you set up your LLC with the IRS you might file business taxes as a corporation a partnership or a single-member LLC. If you file Schedule H Form 1040 PDF you can avoid owing taxes with your return if you pay enough tax before you file your return to cover both the employment taxes for your household employee and your income tax. Nannygate is a popular term for the 1993 revelations that caused two of President Bill Clintons choices for United States Attorney General to become derailed.

If you employ a nanny babysitter maid gardener or other household worker but you arent filing a federal income tax return Form 1040 you must file Schedule H and pay 2021 employment taxes. You should register for an employer withholding tax account to report the taxes for your business employees. If youre wrestling with child support tax questions.

A great nanny is a good communicator. Because you are directing how the nanny should look after your children and because you provide her with the equipment and supplies to do her job the IRS considers her to be a household employee. Only one parent can claim a child and any accompanying tax breaks in any one tax year so be sure to discuss this with your childs other parent.

In January 1993 Clintons nomination of corporate lawyer Zoë Baird for the position came under attack after it became known that she and her husband had broken federal law by employing two people who had. You will need to file IRS Form 2441 with your personal federal income tax return in order to claim the child care tax credit. The 7 Best Nanny Payroll Services.

Grow Your Legal Practice. Using a nanny payroll service can greatly reduce the amount of time it takes you to pay your nanny withhold your nannys taxes file your own taxes and stay up-to-date on state and federal changes to tax laws to. Should You File State Income Taxes.

If you must pay social security and Medicare taxes or federal unemployment taxes or if you withhold income tax youll need to file Schedule H Form 1040 Household Employment Taxes. If youre the employer of a household employee you have a responsibility to withhold and pay certain taxes on their behalf including the nanny tax If you work as a nanny self-employed babysitter or other household caregiver or you employ one youll want to know how to properly prepare your taxes. A great nanny is flexible.

But before you decide to pay either quarterly or annually consult with an accountant or tax professional. Income rates range from zero to almost 13. In either of these situations you will be required to file IRS Form 1040 or IRS 1040-SR along with a Schedule C.

Nannies must be able to adapt to the situations they face. An LLC taxed as a corporation uses Form 1120 to file taxes. Life with children can be unpredictable.

Youre able to take deductions for expenses regardless of whether the babysitting requires you to travel to clients homes or if you do the babysitting within your own home. File tax returns year-round. First lets get the lay of the land and understand everything that goes into calculating payroll whether youre a sole proprietor and are paying yourself or if you need to run payroll for numerous employees.

The form asks for your care-related expenses for the calendar year and then calculates your savings based on a percentage determined by your adjusted. Youll also need to file a Form W-2 Wage and Tax Statement and furnish a copy of the form to your nanny and Social Security Administration. When ranking your favorite seasons we guess tax season isnt at the top.

Web Upload is a file-based system thats best if youre submitting more than a few documents and payments at once. You file using Form 1065 and Schedule K-1. In addition to filing federal income taxes most business owners should also be filing a state income tax return.

Use our nanny payroll calculator to help. If you try to pay a lump sum instead of making quarterly payments youll be charged interest fines and other fees. If youre employed you can ask your employer to withhold more federal income tax from your wages during the year.

The household employer taxes paid on top of the nannys wages. Yes you read that right some states dont have income tax requirements. With Savvy Nannyyoure charged one flat rate for up to two employees with only an extra 6 per person charge after that.

You may be able to file your income taxes with Head of Household status and claim them as dependents. As such taxes need to be paid. The system accepts withholding tax data files such as spreadsheets or text files created using payroll software.

If your LLC has multiple owners its taxed just like a partnership. Nannies have to effectively relay and receive information from parents and children. But you will have to keep it on hand in case youre audited or investigated.

Federal taxes are the taxes withheld from your paycheck that benefit the federal government. Typically on a quarterly basis. If you pay 210000 or more in wages to your nanny then as an employer you are required to pay employment taxes.

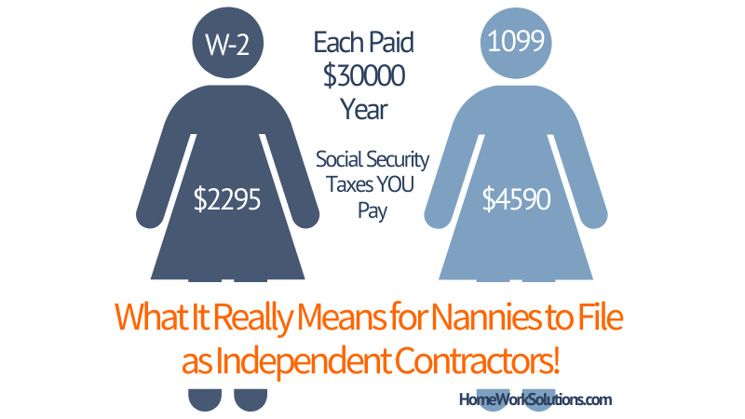

A great nanny is understanding. Nanny taxes are the federal and state taxes families pay as well as withhold from a household employee if they earn 2400 or more during the 2022 year.

Nanny Payroll Part 3 Unemployment Taxes

7 Steps For Filing Taxes As A Nanny Or Caregiver Care Com Homepay

7 Important Actions To Take After You Hire A Nanny

3 Ways To Pay Nanny Taxes Wikihow

Do I Need To Pay Taxes For My Nanny

Nanny Tax Do I Have To Pay It Credit Karma Tax

5 Financial Tips For Millennials Mark J Kohler Tax Legal Tip Youtube Kohler Financial Tips Nanny Tax

This Household Employer S Payroll Tax Checklist Outlines How To Properly Pay Nanny Taxes Read This Guide Today To Better Tax Checklist Nanny Tax Payroll Taxes

Hiring A Nanny Tips On Handling Taxes And Other Costs Mybanktracker

The Differences Between A Nanny And A Babysitter

8 Tax Benefits All Work At Home Moms Should Know About Work From Home Moms Tax Tax Refund

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Babysitting Taxes Usa What You Need To Know

Nanny Payroll Part 4 Federal Income Taxes

Nanny Tax Pitfalls And Need To Knows For Your Taxes